High Impact U.S. Oil Projects on the Alaska North Slope

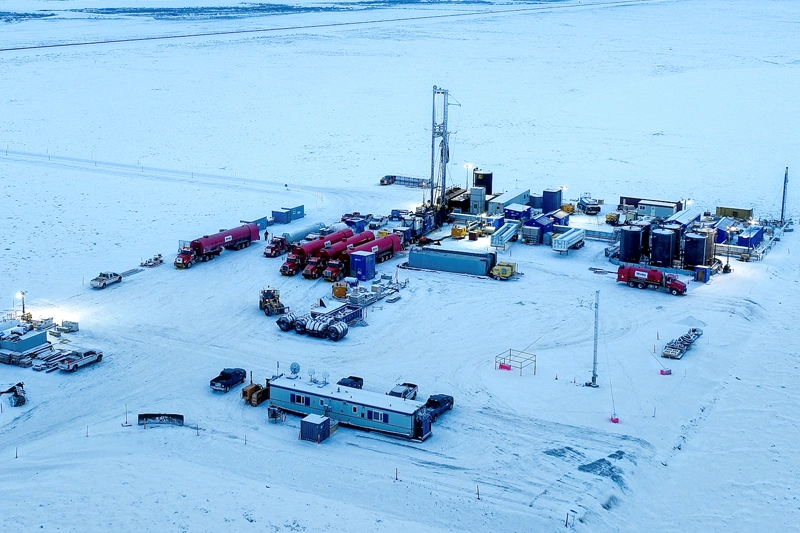

Pantheon Resources (AIM: PANR) (OTCQX: PTHRF) is an independent oil and gas company, headquartered in Houston, focused on developing the Kodiak and Ahpun fields, a portfolio of high-impact oil projects on the Alaska North Slope (ANS), spanning a 100% working interest across 258,000 acres.

Independently certified best estimate contingent recoverable resources currently total c. 1.6 billion barrels of ANS crude and 6.6 Tcf of associated natural gas across the Company’s properties. All acreage is on state lands with supporting regulatory authorities and no federal land use approval required (aside from Army Corps. Of Engineers).

The ANS is a prolific oil province now regarded as a “Super Basin” which is experiencing an exploration and development revival. Pantheon' and its wholly owned subsidiary, Great Bear Petroleum, has been operating in Alaska for over a decade where over $350 million has been invested in building and appraising its portfolio and in 3D seismic.

Pantheon’s Ahpun and Kodiak projects are situated in a unique geographic location adjoining the underutilized export and transport infrastructure for Alaskan North Slope oil and gas activities. These assets are immediately underneath and adjacent to the TAPS (Trans Alaska Pipeline System) main oil line and the Dalton Highway, enhancing the commercial potential and offering a major competitive advantage over other companies’ operations on the Alaska North Slope.

These discoveries have led the Group into a new phase in its corporate strategy, which will see Pantheon transitioning towards the development of these resources with near term focus on the Ahpun field, which has the advantage of being located immediately adjacent to and underneath both the Trans Alaska Pipeline System (TAPS) and the Dalton Highway and which targets first production by the end of 2028, while continuing to firm up estimates of the Kodiak field’s resource base through further appraisal.

The Company’s focus on nearer term development assets adjoining the existing export infrastructure should allow Pantheon to finance its business more conservatively, to enable future funding to be sourced from a position of greater strength whilst minimising potential dilution until the point of cash flow breakeven.

-

2015

Alkaid 1 Drilled

-

Q1

2019Alkaid 1 Flow Test

-

Q1

2021Talitha A Drilled

-

Q1

2022Talitha A Re-entered

-

Q1

2022Theta West 1 Drilled

-

Q3

2022Alkaid 2 Drilled

-

Q4

2022Alkaid 2 Flow Test

-

Q3

2023NSAI Resource Statement

-

Q4

2023Alkaid-2 Recompletion

-

Q2

2024Updated NSAI Resource Statement

-

Q2

2024Alkaid IERs

-

Q2

2024GSPA with AGDC

Drilling by Pantheon/Great Bear Petroleum and adjoining operators has highlighted the significant prospectivity of Pantheon’s acreage, offering billions of barrels of oil and other marketable liquid potential in stacked conventional targets across multiple geological plays.

Netherland, Sewell & Associates completed an independent review of the Kodiak field and provided best estimates of the oil, condensate and NGL contingent resources expected to be recovered, totalling 1.2 billion barrels. This validation in the form of an Independent Expert Report (IER) from one of the world’s most respected petroleum property analysis companies has instilled further confidence in management’s modelling of the resources.

Pantheon’s near-term focus is to prove the resource, reserve and commercial potential of its Ahpun project, where the Company believes a significant commercial resource has been discovered and successfully tested at Alkaid-2. In Q2 2024, Pantheon received an Independent Expert Report from Lee Keeling & Associates (LKA) on the Ahpun Alkaid horizon, estimating 79 million barrels of recoverable reserves. Later in Q2 2024, a report was received from Cawley Gillespie & Associates (CGA) on the Ahpun western topsets, estimating 282 million barrels of contingent recoverable resources of marketable liquids.

Alaska Gasline Development Corp. - Gas Sales Precedent Agreement

In June 2024, Pantheon entered into a Gas Sales Precedent Agreement with Alaska Gasline Development Corporation (AGDC), a state-owned entity leading the efforts for the development of the Alaska LNG Project – a proposed major infrastructure project designed to commercialize natural gas from the ANS to the global marketplace. Under the agreement, Pantheon agrees to provide up to 500 million cubic feet of gas to Southcentral Alaska through the natural gas pipeline (Phase 1) on terms that provide funding capacity to support all of Pantheon’s expected development costs after Ahpun Field Final Investment Decision. Pantheon is currently expected to serve as the sole supplier of gas for the pipeline.

Pantheon believes that material borrowing capacity supported by the agreement has the potential to be enough to achieve financial self-sufficiency for full Ahpun and Kodiak developments, and will also result in material gas disposal cost savings to Pantheon.

Pantheon’s agreement with AGDC creates an optimal alignment of interests with the State of Alaska. The objective is for Pantheon to provide lower cost gas than alternatives – a win-win benefitting Alaskan consumers faced with looming supply shortfall. Furthermore, the agreement removes reliance on LNG exports to support pipeline construction costs which enhances the overall Alaska LNG project.

Latest Announcements

Latest Webinar

Investor Update

May 2025

Ahpun

Kodiak