Pantheon Resources was listed in 2006 as an independent UK based oil and gas exploration company focused on hydrocarbon producing basins located onshore USA – a region of low sovereign risk, abundant infrastructure and established oil and gas markets. The Company was admitted to the AIM segment of the London Stock Exchange on 5 April 2006.

In 2019, the Group acquired 100% of the oil assets of Great Bear Petroleum, a private company which had spent over a decade building a significant portfolio of high quality, high potential properties on the Alaska North Slope, which Pantheon strongly believed offered enormous size and scale in a world class setting. Over $200 million had been invested in the project at that time, providing a comprehensive understanding of the subsurface through a proprietary dataset. This figure is over $350 million in investment to date.

Pantheon now has a host of discovered resources that it has continued to mature as the Company has transitioned from what was an early-stage speculative exploration company, into an appraisal company with an intention of becoming a development and production company after FID is reached on its Ahpun project which is targeted for late 2025. Over the years, Pantheon has used its proprietary data set to carefully and strategically build and optimise its acreage position across the ANS where it now owns 100% working interest across c.258,000 contiguous acres covering the Kodiak and Ahpun projects and is the Operator.

Pantheon's project areas are advantageously located under and adjacent to the main oil transportation pipeline (Trans-Alaska Pipeline System or "TAPS") and underneath and adjacent to the main road transportation artery, the Dalton Highway. All Pantheon projects are on State lands.

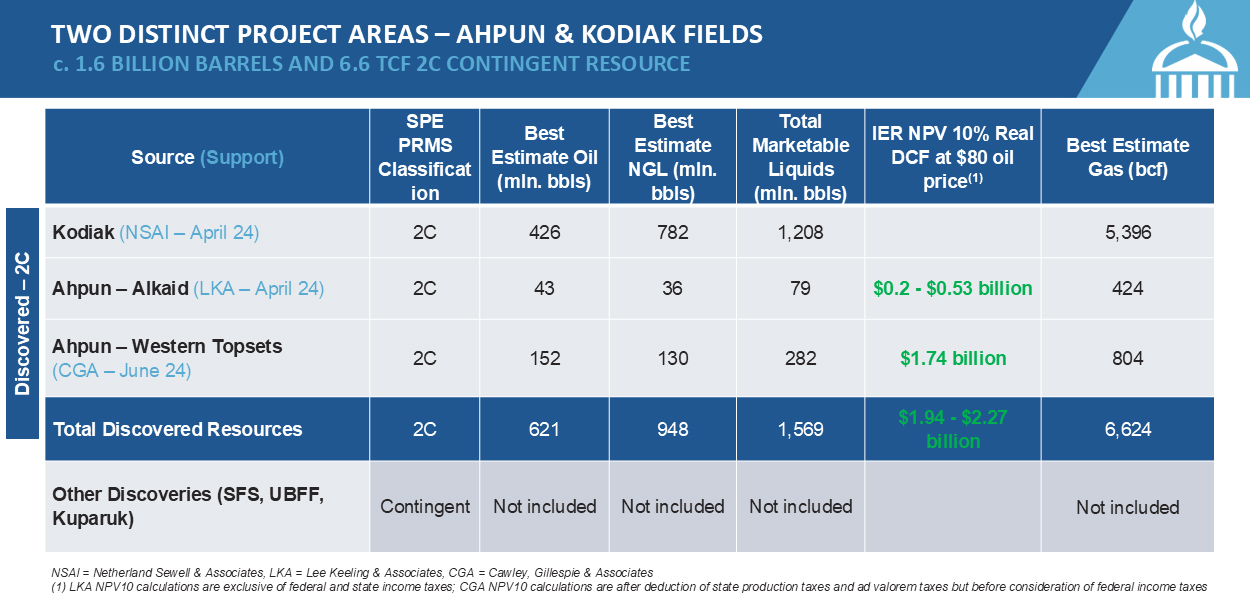

In 2024 Pantheon received 3 separate Independent Expert Reports which estimate a total 2C contingent resources of 1.57 billion barrels of ANS Crude and 6.6 Tcf (trillion cubic feet) of gas. A summary of Pantheon's resources is provided in the table below. In June 2024 Pantheon signed a Gas Sales Precedent Agreement with the Alaska Gasline Development Corporation AGDC for the proposed 20-year supply of Pantheon's natural gas into the proposed gas pipeline presently being evaluated as Phase 1 of "Alaska LNG". In November 2024 Wood Mackenzie published a report which concluded the Alaska LNG project had the potential to provide up to $16 billion worth of economic benefit to the State of Alaska.