The Alaska North Slope (“ANS”) is recognised as a prolific oil province that is seeing a resurgence of development activity and exploration.

The current 500,000 barrels of oil per day (“BOPD”) transiting the Trans Alaska Pipeline System (“TAPS”) is forecast to rise and likely exceed 1,000,000 BOPD over the next 10 years. At the same time as the oil renaissance, management believes the prospect of gas exports from the ANS has never looked better.

The North Slope remains underexplored and is rated as an immature exploration province in terms of well density-to-reserves and production, confirming the immense potential proven by recent discoveries including the rumoured King Street discovery by Apache, Armstrong and Santos during 2024. IHS Markit believes the ANS is a “Super Basin ready for oil resurgence as oil production is expected to grow 40% in eight years.”

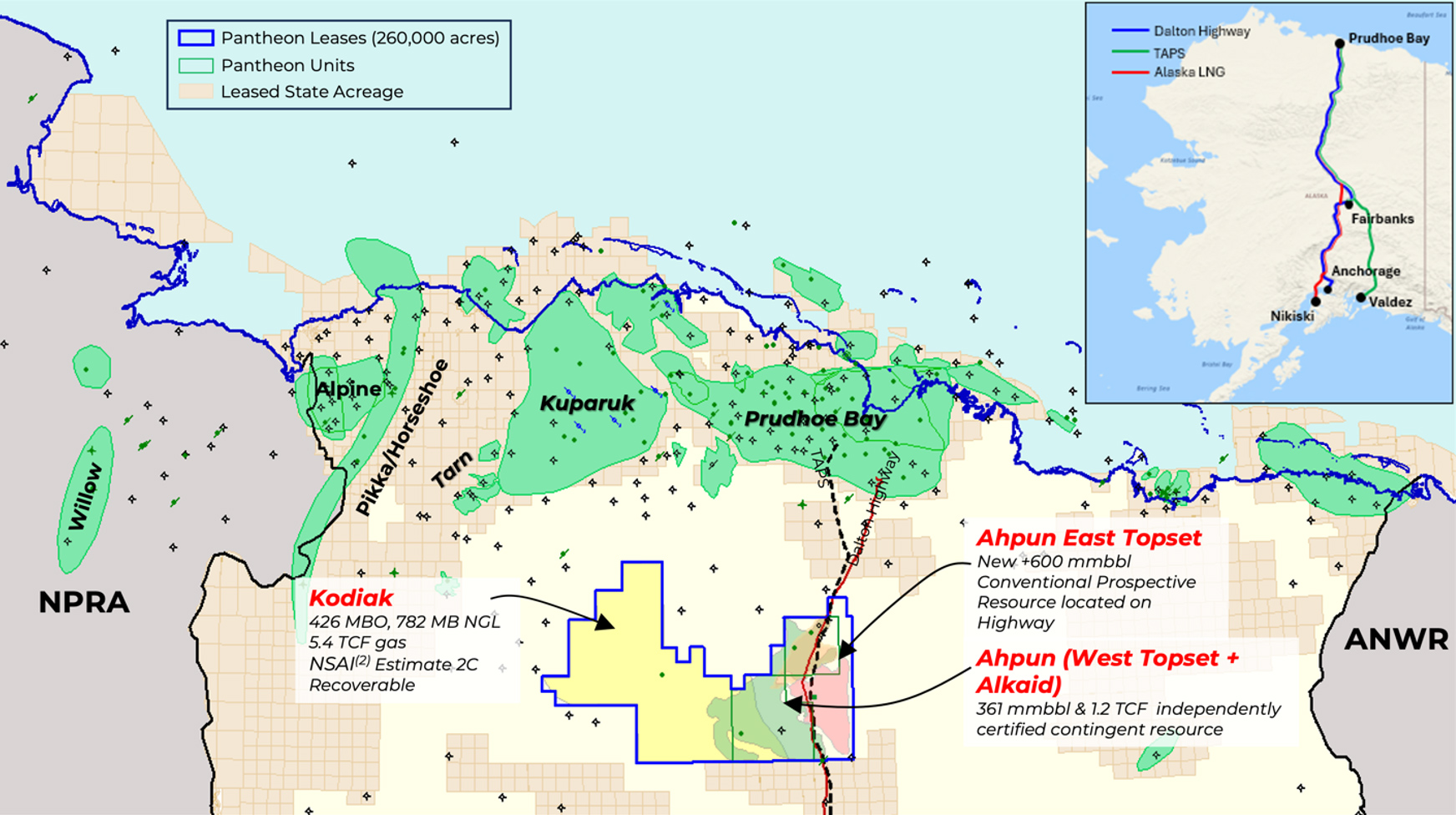

Pantheon is a large leaseholder on the ANS where it controls a 100% working interest in a contiguous acreage block of c. 258,000 acres, to the south of the giant Prudhoe Bay and Kuparuk oil fields. This acreage is covered by c. 900 square miles of mostly proprietary 3D seismic and contains two giant discovered oil fields with additional world class exploration prospects.

As part of the USA, Alaska enjoys well understood sovereign risk ratings and has among the best fiscal regimes for petroleum development in the world, which is ideal for an operator such as Pantheon to pursue impactful oil ventures.

Route to Market

Oil Export

The TAPS main oil line is in its fifth decade of operation and is a federally regulated common carrier pipeline. The blend of production streams from Prudhoe Bay, Kuparuk River and all the other fields feeding into the TAPS constitutes Alaska North Slope Crude Blend, which is exported by tankers at Valdez and delivered to US West Coast refineries. The quoted benchmark, ANS Crude Blend, is the price of the blended Alaska North Slope liquids stream when delivered to the US West Coast so the value at the entry to the TAPS main oil line is less than the quoted ANS Crude Blend price by the cost of seaborne transport from Valdez and the TAPS tariff.

The liquid hydrocarbons that Pantheon will produce have a different composition than the legacy production through the pipeline. The principle by which a common carrier pipeline allocates barrels injected into the pipeline vs barrels lifted from the export point is to ensure that, so far as possible, each shipper gets out the same value of ANS Crude blend as the value of the liquids that they put in. Therefore, Pantheon’s production from Ahpun and Kodiak would be subject to what is known as a Quality Bank adjustment resulting in an expected 10% shrinkage factor through TAPS (Ahpun Field export volume vs ANS lifted volume at Valdez).

Gas Export

In the absence of any pipeline or other market from the ANS, excess associated gas not used to produce electricity for field operations will be re-injected into reservoir. However, in June 2024, Pantheon entered into a Gas Sales Precedent Agreement (“GSPA”) which has helped to rekindle the Alaska LNG project by allowing it to be broken into its different components. Phase 1 of Alaska LNG will be the 800 mile, 42” pipeline from the North Slope to Southcentral Alaska to serve in-state gas demand. Subsequent phases will include the Arctic CCS project and the LNG export project from Nikiski.

Helpful Links

- Alaska LNG Project Overview

- Economic viability assessment and economic value of Alaska LNG project by Wood Mackenzie delivered at AGDC Board of Directors Meeting: September 12, 2024