Kodiak - 1.2 billion barrels of marketable liquids independently assessed by Netherland, Sewell & Associates (“NSAI”).

To read the full report, please click here.

Kodiak Field: Gross 100% Working Interest Contingent Recoverable Resources

| Resource Category |

Oil (million bbls) |

NGLs (million bbls) |

Residual Gas (BCF) | Total Marketable Liquids* (million bbls) |

|---|---|---|---|---|

| Low Estimate (1C) | 168.5 | 299.9 | 2,151.7 | 468.3 |

| Best Estimate (2C) | 425.8 | 782.1 | 5,396.3 | 1,207.9 |

| High Estimate (3C) | 1,029.7 | 1,811.6 | 11,748.6 | 2,841.3 |

* Pantheon addition of Oil & NGLs

Project Overview

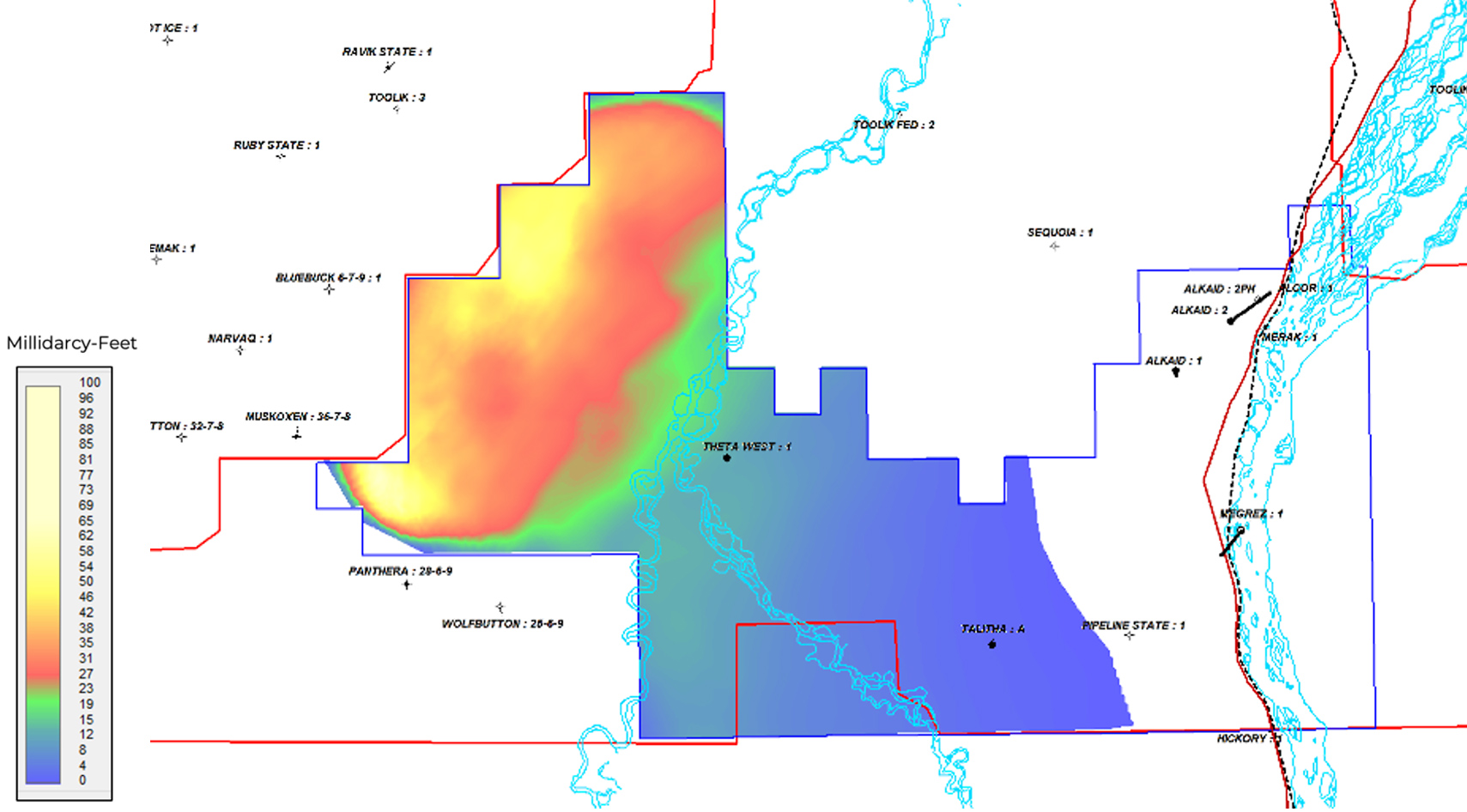

The Kodiak project covers approximately 170,000 acres, partially underlying and immediately to the west of Ahpun. This is a world class project in an excellent location that will benefit from the infrastructure created in the Ahpun project. The field consists of a giant basin floor fan and was described by Wood Mackenzie in March 2023 as “the fourth biggest discovery well globally in 2022” and largest onshore. They have subsequently listed it as one of the top 20 oil discoveries of the 21st century.

Kodiak was discovered in the Talitha-A well and successfully appraised in the Theta West-1 well approximately 10 miles northwest and some 1,500 feet shallower. The Company’s proprietary 3-D seismic data indicates the field extends a further 12 miles to the northwest of Theta West-1. Additional appraisal wells will be required to determine the extent to which reservoir quality improves in the shallowest regions of the field.

This map shows how the permeability thickness varies in the basin floor fan that constitutes the Kodiak field. It shows the effective cut-off to the east beyond which the reservoir quality is considered too poor to flow at commercial rates with current technology.