Ahpun is categorized into 3 project areas:

1. Ahpun - Western Topsets

Located immediately to the West of the Dalton Highway, the Independent Experts at Cawley Gillespie & Associates (“CGA”) have estimated a 2C Contingent Recoverable Resources in the Ahpun – Western Topset horizons as follows:

|

|

Gross Quantities |

| Oil -mmbbl | 152.48 |

| NGL - mmbbl | 129.58 |

| Total of Oil and NGL - mmbbl | 282.06 |

| Gas - bcf | 803.85 |

2. Ahpun - Alkaid

The smallest of Pantheon’s project areas, the Alkaid Zone is similarly located immediately west of the Dalton Highway, however in a deeper geological setting. The independent experts at Lee Keeling & Associates have estimated a 2C Contingent Recoverable Resources in the Ahpun – Alkaid project areas as follows:

|

Base Case |

Estimated Remaining Gross Reserves / Resources |

||

| Classification | Oil (MBBLS) |

Wellhead Gas (MMCF) |

NGL (MBBLS) |

| Possible Reserves |

2,800 | 27,389 | 2,328 |

| Contingent Resources |

40,501 | 396,183 | 33,676 |

| Total Resources |

43,300 | 423,572 | 36,004 |

3. Ahpun – Eastern Topsets

Megrez-1 targeted horizons immediately east of the Dalton Highway. Pantheon spudded the well in November 2024 and undertook a flow test programme during spring of 2025. No appreciable mobile oil was produced from the test intervals, and as a result, the Company’s guidance is that no recoverable oil resource should be attributed to the horizons penetrated by Megrez-1.

The results of the Megrez-1 exploration well have no bearing on the already discovered 1.57 billion barrels of marketable liquids (ANS Crude) and 6.6 Trillion Cubic Feet of natural gas independently certified resources on the Company's Ahpun and Kodiak projects.

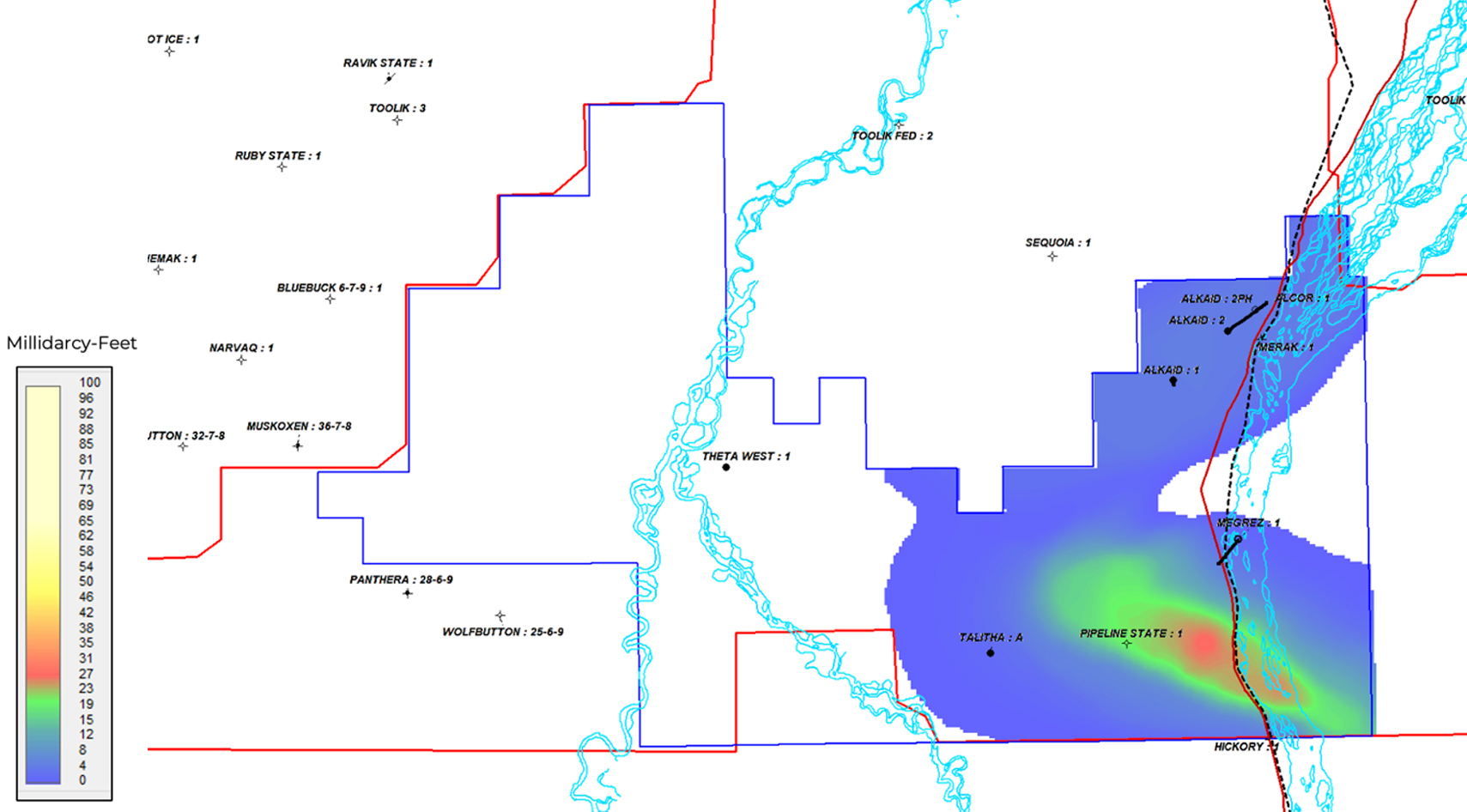

Ahpun West Topset Reservoir

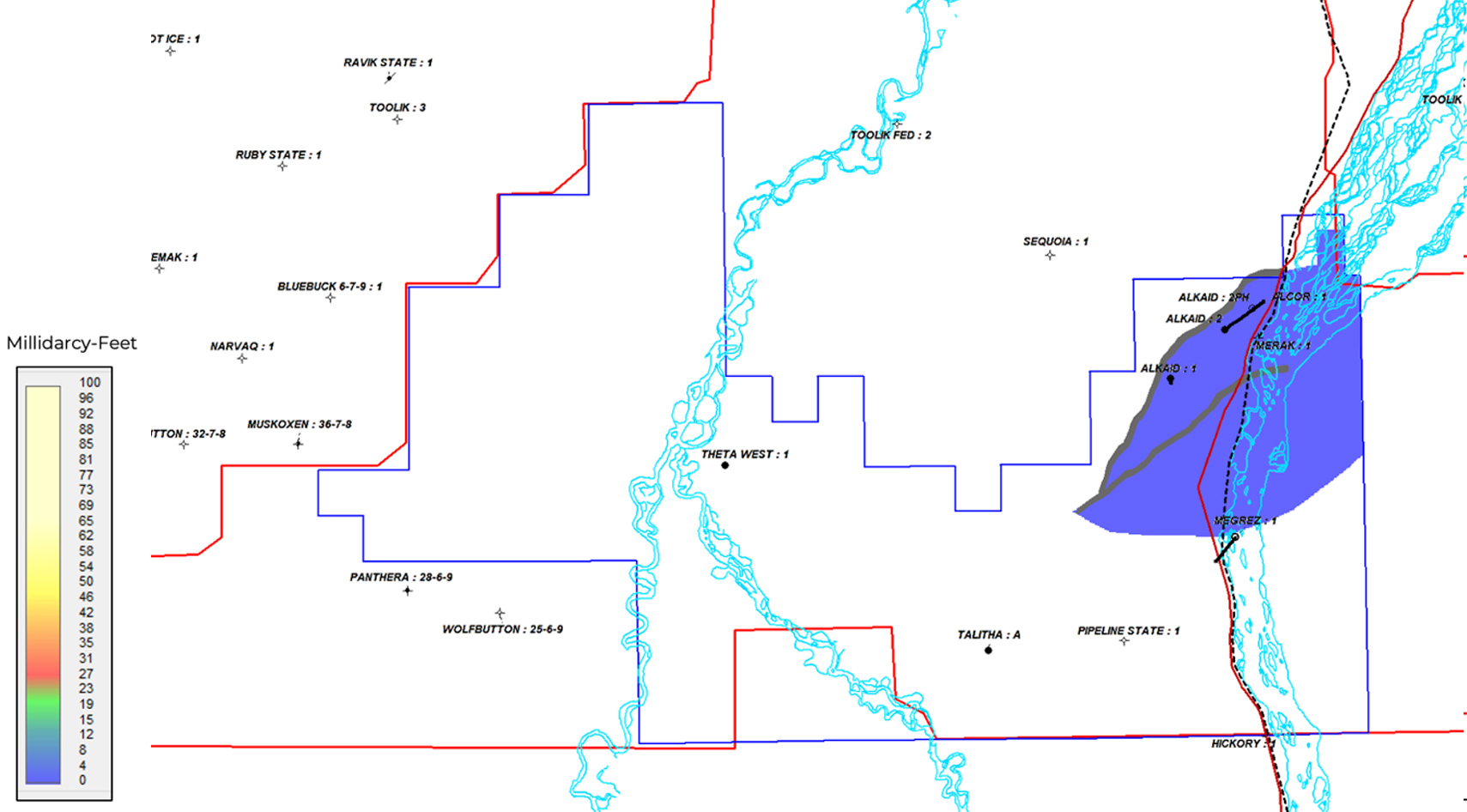

Ahpun West Alkaid Reservoir

Project Overview

Ahpun was originally discovered in Arco’s 1988 Pipeline State-1 well and appraised by Pantheon’s Alkaid-1, Alkaid-2 and Talitha-A wells. It is situated underneath and adjacent to the Trans Alaska Pipeline Systems (“TAPS”) pipeline and the Dalton Highway. This advantaged location of Ahpun enables lower capex and faster development horizons compared to all other new oil field developments on the Alaska North Slope (“ANS”).

The Ahpun field is comprised of a set of deltaic topset horizons which contain the predominate resource in the field and the Alkaid Zone, a smaller and deeper accumulation around one quarter the size of the topset horizon. The Company's strategy is to progress Ahpun field development with a goal of cashflows by 2028 and financial self-sufficiency by 2029.

The figure on left shows how the permeability thickness of the Ahpun West reservoir varies and compares to the Alkaid horizon. Expected development well flow rates are directly proportional to the permeability thickness of the reservoir and these maps demonstrate the expected improvement in the Ahpun West topsets compared to the Alkaid horizon.

The near-term benefits of using modular production units in the early stages of the production operation are to expedite early cashflow and minimise initial capex, while acquiring valuable production data to assist future development planning. It also reduces development risk as the Company builds towards the target of financial self-sufficiency. In due course, a Central Processing Unit (CPU) with full facilities will optimise investment in full field capacity as the Company exploits the entire resource potential.

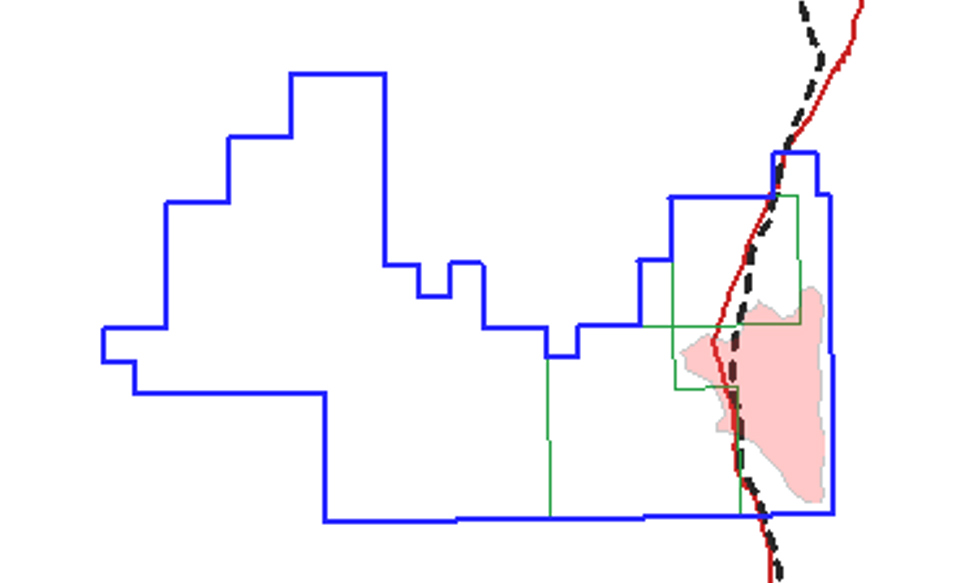

2024 Acquired Leases

The maps on the left highlighted the potential for further topsets extending to the East of the Dalton Highway. The seismic (and subsequent flow testing) indicated a high quality reservoir. Furthermore, the cores, cuttings and logs from the Megrez-1 well and, despite indicating material oil saturations and reservoir properties that would support commercial production rates under normal circumstances, no mobile oil was discovered in the tested intervals.

Pantheon is able to return to Megrez-1 in the future once permanent production facilities are in place, to allow for long term flow testing to proceed at a lower cost. There is no guarantee that oil will flow at commercial rates in a subsequent test, but the high oil saturations and other data indicate the opportunity to learn more about the potential for commercial exploitation through future testing.